Navigating the Future: Embracing Client Accounting & Advisory Services at R Accounting

In today's increasingly complex business environment, clients of all sizes need to make quick, informed decisions. This is a perfect opportunity for firms to adopt a proven business model and start delivering strategic advisory roles to their clients. At R Accounting Group, we have been on a journey to define our relationship with our clients through the lens of Client Advisory Services (CAS) since our start. Here, we'll explore what CAS is, how it differs from traditional models, tips for success, the benefits it brings to firms and clients alike and how we at R Accounting frame it within our client relationships.

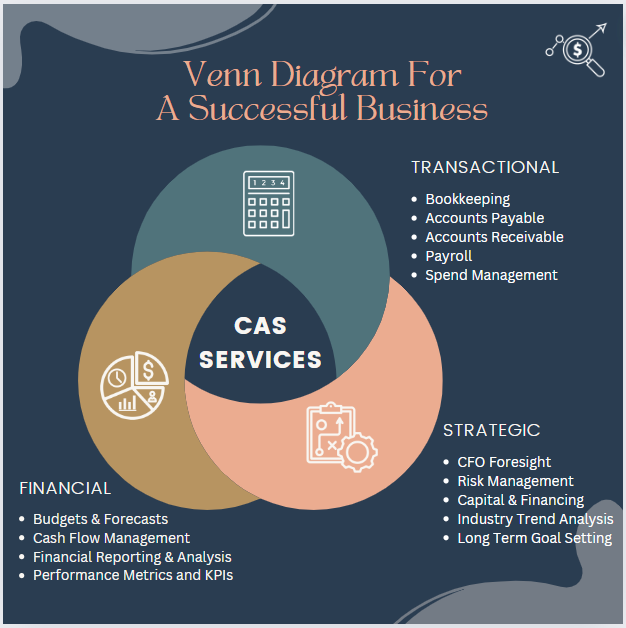

Defining Client Advisory Services

Client Advisory Services (CAS) represent a shift from traditional compliance-based services to a more proactive and strategic role. Instead of merely crunching numbers and ensuring regulatory compliance, CAS involves working closely with clients to provide insights, strategies, and support to help them achieve their business goals. At R Accounting, our CAS services have always been based on the premise that solid financials reflect business decisions and their impact. From the start we opted to use QuickBooks Online (QBO) as the financial hub for our client information, ensuring streamlined and efficient management of financial data.

A New Way of Relating to Clients

Traditional accounting often revolves around historical data and compliance. CAS, on the other hand, is forward-looking, requiring a deep understanding of the client’s business, industry trends, and potential challenges. This shift means adopting a more consultative approach, focusing on understanding the client’s vision and providing tailored strategies to meet their objectives. It’s about being a trusted advisor rather than just a service provider.

For R Accounting, this mindset has involved building stronger relationships with our clients. We work with a smaller client portfolio to allow us the bandwidth to understand their day-to-day activities. We listen more, ask deeper questions, and familiarize ourselves in their business operations. We view CAS as a partnership, leveraging our business and operational expertise to offer actionable advice that drives growth and efficiency for our clients. This approach differentiates us from competitors and builds long-term trust and loyalty.

Tips for Success in Offering Client Advisory Services

Pick a Lane: There are a lot of apps, software and channels in the business financial space and no one can be knowledgeable about them all. There is a fine line between “If it’s not broke, don’t fix it” and “Change for the sake of change” ~ and FOMO and Shiny Object Syndrome have derailed many plans. Conduct your due diligence and evaluate your options ~ and move forward. Many of the apps offer similar features so app hopping is not always beneficial. As a QBO-centric firm, all our apps are viewed through the lens of how information will transmit to that central core.

Invest in Training and Technology: Effective CAS requires the right tools and continuous professional development. Our team undergoes regular training to stay updated on industry trends and technologies that benefit our clients and all test to renew their QBO ProAdvisor credentials annually. We are also selective about our technology to ensure planned changes.

Understand Your Client’s Business: It's essential to have an in-depth understanding of each client's business. This involves regular check-ins and being genuinely interested in their success. We make it a point to familiarize ourselves with our clients' industries to offer relevant and practical advice.

Communicate Clearly and Often: Communication is key in CAS. Regular, clear, and open communication helps in understanding client needs and providing timely advice. We use various communication tools to stay connected with our clients, ensuring we are always accessible and have regularly planned meetings.

Offer Personalized Services: One-size-fits-all doesn’t work in CAS. Tailor your services to meet the specific needs of each client. We pride ourselves on our ability to customize our offerings within the framework of our service tiers to each client’s specific needs.

Round-Table Advisory: Connect and collaborate with your client’s other professional service providers. Knowing your clients’ tax group, insurance brokers, and banking relationship managers allows for more direct and deeper discussions on your client’s business.

Develop Relationships: Know what you know, familiarize yourself with others in your industry and with other professionals within your community and do not hesitate to advise a client that their question is outside your scope and they should be speaking with… an attorney, a benefit specialist, a realtor. Be cautious about recommendations as there can be repercussions. ‘Sharing contact information for several professionals in the field…’ can generally serve as a reliable disclaimer.

Powerful Benefits of Offering Client Accounting Services

The shift to CAS brings numerous benefits to both firms and clients:

Enhanced Client Relationships: CAS helps build stronger, more meaningful relationships with clients. By positioning ourselves as strategic partners, we create a deeper bond based on trust and mutual growth.

Improved Client Retention: Clients who see the value in advisory services are more likely to stay loyal. The proactive nature of CAS ensures clients feel supported and valued, leading to higher retention rates.

Professional Satisfaction: For our team, CAS brings a greater sense of fulfillment. Helping clients succeed and seeing the tangible impact of our advice is incredibly rewarding.

Increased Revenue Streams: Offering CAS can lead to new revenue streams. Clients are willing to pay for valuable insights and strategies that drive their business forward.

CAS in Action

In my industry career, working with privately owned businesses and growing organizations have been the most rewarding chapters. Being involved in decision-making that shapes the next phase of a company’s journey and seeing its growth felt wonderful. Helping organization owners reach their goals is incredibly powerful. And now, to be part of that role with our clients, helping them clarify and then strategize their dreams and goals is equally rewarding. We love being part of their teams and journey as we, as a small business ourselves, continue to build out our own dreams and goals.

One of our earliest clients, a small business started by several firefighters, began their journey with us almost a decade ago at +/- $3 million in revenue. They had big dreams of growth, expansion, and future acquisition. Despite challenges, especially during 2020, their team leaned into operational efficiencies, project margin reviews, and staffing optimizations. Last year, they reached nearly $10 million in revenue and achieved many of their goals ~ and their software journey has followed their business journey, with a migration from QBDT to QBO Advanced to assist them in developing a system that would support their growth in operations.

This success story highlights the impact of CAS. Experiences like these reinforce our commitment to the advisory role and the value it brings to our clients.

Embracing Client Advisory Services has allowed R Accounting to elevate our service offerings, deepen client relationships, and drive mutual growth. As the business landscape continues to evolve, we are excited to be at the forefront, helping our clients navigate their challenges and seize opportunities. We encourage other firms to explore CAS and experience the transformative benefits it can bring.

*This blog was created as part of our paid partnership with Intuit*