How the Inflation Reduction Act May Affect the 2023 Tax Filing Season

How the IRS has made positive changes because of the new law, and which tax credits might affect you.

The Inflation Reduction Act of 2022, which we covered in a column last year, is starting to produce changes in the U.S. in many ways. While it’s true that the new law passed last August may not have had a lot of direct impact on today’s lower inflation rate, it’s a 10-year plan. The IRA could still eventually reduce inflation by, “…making the economy more productive and reducing reliance on oil,” according to Investopedia.

We looked around to see how the new laws could directly affect you during the 2023 tax season. We found two areas that might be of interest to you:

1. Changes at the IRS itself

2. Tax credits you could still qualify for during 2023

IRS Improves Service

You may recall that the IRS received substantial funding from the IRA. The agency has already put it to good use. It has, for example:

· Answered 3 million more calls

· Cut phone wait times from 28 minutes to three

· Met with 140,000 more taxpayers in person

· Implemented a new scanning technology that has allowed them to digitize 80 times more returns than in 2022

The Paperless Processing Initiative was put in place using IRA resources and is expected to help eliminate paper backlogs and speed up refunds. The process of scanning and e-filing paper returns has already accelerated. The IRS has thus far scanned 225 times more returns than it did in 2022. By the 2025 filing season, the IRS hopes to have digitize all paper returns when they’re received.

Customer callbacks should come faster. Taxpayers will be able to respond to dozens of the most common “notices” (those letters the IRS sends when it needs more information or clarification) online rather than through the U.S. Mail. A new online portal allows businesses to file Form 1099s electronically rather than through the mail. Pop-Up Taxpayer Assistance Centers will become more common, giving taxpayers in hard-to-reach areas the opportunity to meet face-to-face with IRS representatives.

The Customers page displays transactions that need additional attention to bring in the money you’re owed.

Businesses will be more likely to file IRS Form 1099s electronically.

Are You Eligible for Tax Credits?

The Inflation Reduction Act expanded many existing credits that will affect individuals, businesses, tax exempt organizations, and government entities. Last month, we talked about the Energy Efficient Home Improvement Credit, which is reserved for installations of things like water heaters, exterior windows and doors, and heating and air conditioning units in homes. You may qualify for a tax credit up to $3,200 (Part II of Form 5695 is required).

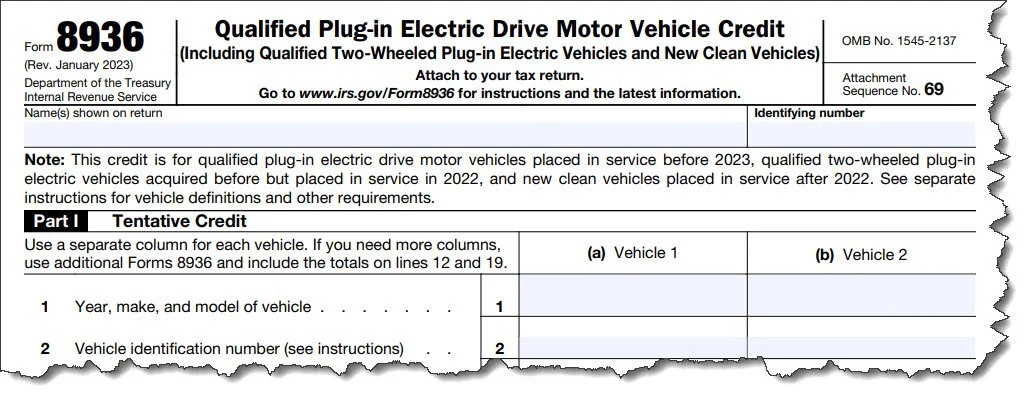

There are others, including the Clean Vehicle Tax Credit. This credit for purchasing electric vehicles has existed since 2008, but its requirements changed under the IRA, making it harder to qualify for. Credits range from $2,500-7,500, depending on a lot of things, including battery capacity and the geographical location where minerals and battery components are lined and manufactured. Vehicles placed in service before 2023 may also be eligible. You can learn more here.

If you’re a business or tax-exempt organization and you purchase a qualified commercial clean vehicle, you may qualify for a tax credit of up to $40,000. The Commercial Clean Vehicle Credit does not limit the number of vehicles you can claim, but this is a nonrefundable credit. That is, you can’t claim more than the total that you owe in taxes. At this writing, the IRS has not yet produced a form for this credit, but it should be available by filing time. You can get more information here.

Your customers will be likely to pay faster if you make it easier for them to do so.

You may be able to claim up to a $7,500 tax credit for buying an electric vehicle.

More IRS Enforcement

Using the funding made available by the Inflation Reduction Act, the IRS will also be taking steps to ensure that high-income earners pay all the taxes they owe. In the last several months, IRS Criminal Investigation has closed numerous cases. Wealthy taxpayers have been sentenced for tax evasion, money laundering, and filing false tax returns, according to the agency.

Are You Preparing for 2023 Income Taxes Even Now?

If you’ve made a habit of thinking about how your income and expenses will affect your 2023 taxes throughout the year, you’re ahead of the game. At the very least (and especially if you’re self-employed or own a small business), you should be creating regular reports on what’s you’re taking in and spending. If you don’t know where to start with this, though, let us know. We can provide guidance on year-round tax planning and even prepare your taxes when that time rolls around.