Did You Miss the Tax Deadline? What You Should Do

April 15 has come and gone, but it’s definitely not too late to file your income taxes. In fact, you should.

If you haven’t yet filed your 2023 income taxes, you’re not alone. There are so many reasons why people miss this critical deadline. You might have been busy and just didn’t get around to it. Or maybe you knew you’d owe money but didn’t have it. You could even have an outstanding return from a previous year and didn’t think the IRS would still accept it.

Better late than never definitely applies here. If you have taxable income and don’t submit a 1040, you could face a whole range of problems that you don’t want to have.

You might, for example:

● Miss out on Social Security benefits. If you’re self-employed and don’t file, you’ll lose credit for that year’s income.

● Lose a refund owed you. The IRS allows you to claim a refund for up to three years after the date the related return was due.

● Be unable to supply your tax return to potential investors or lenders.

● Owe the IRS penalties and interest.

Submit It Quickly

Prepare and file your missing return ASAP. The IRS posts forms, instructions, publications, and notices dating back to 1864 here.

Prepare and file a past-due tax return as soon as you realize you missed it.

Can’t pay what you owe? File anyway. The IRS may grant you an additional 60-120 days to submit the total amount. But make contact with the IRS about your missing taxes by at least sending in your return. If you absolutely can’t afford to fulfill your entire obligation, you should be able to set up a payment plan with the IRS and pay in installments.

What the IRS May Do If You Don’t File

The IRS may take action on its own if you don’t file a tax return. They could create what they call a substitute return. This is not a good thing for you, since the IRS’ version is unlikely to give you credit for all of the deductions and exemptions you may be entitled to receive. If they do this, they will send you a CP3219N, a Notice of Deficiency (90-day letter). You’ll have 90 days from the date of the notice to challenge (in Tax Court) the tax the IRS proposed.

You can’t request an extension once you’ve received this notice. You should, though, go ahead and prepare and file your own return, including any exemptions, credits and deductions the IRS might have missed. If your reported income is incorrect, contact the source of the W-2 or 1099 and request a corrected one. You should include this with your return when you file.

What if you don’t respond to the 90-day letter? The return that the IRS prepared will stand, and you’ll receive a tax bill from the agency. If you don’t pay this, the collection process will be triggered. And you know what that can mean. The IRS can slap a levy on your bank account or wages or file a federal tax lien. You could even face criminal prosecution. So we strongly urge you to prepare and file past-due federal tax returns as soon as possible – whether or not you’ve received a notice, but especially if you have.

Need to Obtain Past Returns?

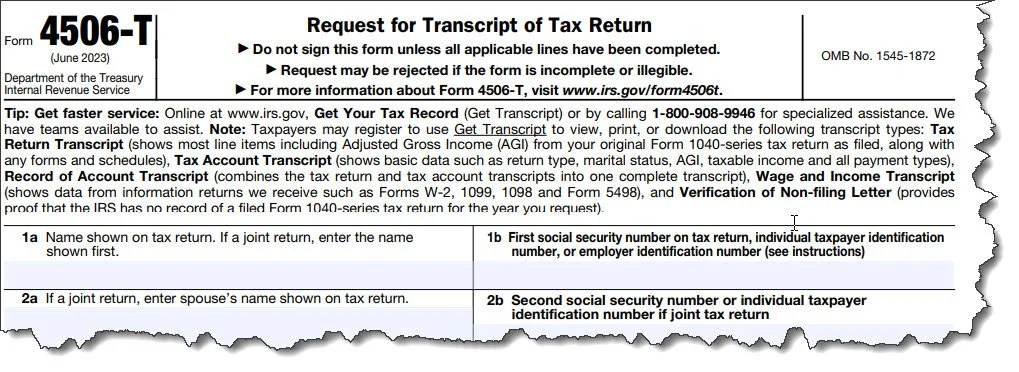

You can file a Form 4506-T if you need to see tax returns from previous years.

You know that when you’re preparing a tax return, you occasionally need information from a previous one. What do you do if you didn’t keep the tax return you need? You can get it from the IRS in one of two ways. You can complete and submit a Form 4506-T, as pictured above. Or if you’d rather, you can get a transcript, which protects your information from identity theft by partially masking personal information. You can learn about obtaining them here.

Where Do You Send Your Past-Due Returns?

If you noticed on your own that you didn’t file a tax return for a particular year and want to do so, you should send it to the address originally provided. But if you received a notice, send it to the address listed on that letter. According to the IRS, it can take up to six weeks to process a past-due tax return.

Not Necessarily An Easy Task

If you must reconstruct your income and expenses from a past year, you may find it challenging. It’s nerve-wracking enough to realize that you missed a tax deadline, and correspondence from the IRS always causes anxiety. Let us help walk you through this process so you’re sure to get it right. We can also help you with tax planning throughout the year so you don’t face this situation again.